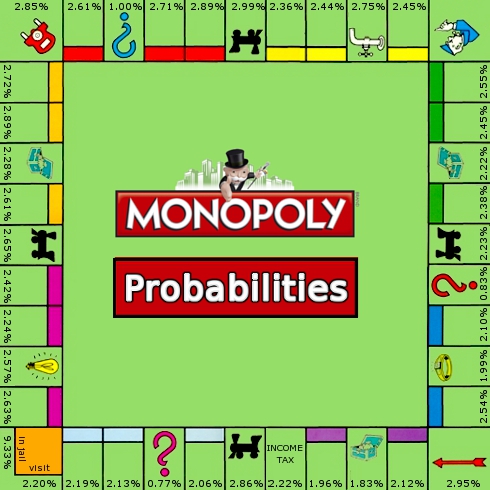

So called 'One Point Estimates' (OPEs) fill up our lives, but are useless without context. What can we do?

Some common real live OPE examples: 'Speed Limit 100', 'Temperature 70° ', 'Post Stamp 33', etc....

To give 'estimates' meaning, we have to put them in context:

The way to stretch a point, is to stretch your mind.

Let's tak a look at a simple example.

Level 1: Your pension fund reports a 90% Funded Ratio

Just reporting a 90% Funded Ratio (FR) is in fact no-information. It's what I call a 'One Point Estimate' (OPE) that hardly adds any relevant information to you as a pension fund member.

At the best, it only raises questions.

More likely, this information leads to misunderstanding, confusion or even panic.

Level 2: The Funded ratio reported on a time scale

Reporting values on a 'time scale' is often the first attempt to stretch information in order to enable pension fund members to gain insight into the (future) development and direction of the funded ratio.

This kind of reporting gives pension fund members an idea about the short term variance and direction of the funded ratio, but still lacks information about 'how' and 'why'.

Level 3: Reporting values as function of their dependent variable(s)

On this level the added value of stretching an OPE becomes really visible.

Key question you have to ask yourself is: what are the main variables that influence the outcome (funded ratio) most?

As the expected future return and/or discount rate is one of the most relevant variables, it's illustrative and clarifying to express the funded ratio as a function of for instance the discount rate.

By doing so, every pension fund member can conclude that (in this case) the pension fund needs a future return of at least 4% p.a. to meet its obligations and that the 'solution area' (triangle 'A'), gives visible information about the 'space' or room for future indexation or pension-improvement at higher return rates.

Level 4: Adding additional information 1:Future Longevity Effect

Our two-dimensional diagram is now enriched with additional information of other vital variables that influence the pension funded ratio outcome.

We start with the estimated effect of future longevity development.

As pension fund members can note, the solution triangle area 'A' is now substantially reduced and a minimal return of (in this case) 5% is needed to fund pensions in a sustainable way.

Next, several confidence levels, based upon (future) regulatory demands, are plotted in the diagram.

For example, we may plot:

In this case it becomes visible and clear to every pension fund member (and probably also every pension fund board member!), that 'more secure confidence levels', as well as 'future upcoming regulatory confidence levels' demand unrealistic high returns of this pension fund under study. As the confidence level increases, the solution area 'A' stepwise shrinks to zero.

In this specific case the pension fund has no other choice than to lower its future pension rights or to accept a higher risk of not meeting its pension obligations.

Key Question

Key question for YOU: Have you done the above exercise with your pension fund?

Pleas answer this question Honestly...

If the answer is NO, just keep on hoping things will turn out for the best......

By the way, you don't need to be an actuary to ask your pension board to inform you by means of the above formulated simple diagrams. I hope you get clear answers...

What's the difference between 'Pension Board' and 'Pension Bored'?

First, just watch the next video in which New York State Comptroller Thomas P. DiNapoli tries to explain that based on the fact that NYSCRF has 'worked' for more than 90 years, it will continue to work for many years to come.

Although Thomas DiNapoli probably does his utmost best and tries to reassure us that NYSCRF is fully under control, communication and taken measures unfortunately do not underline this standpoint:

NYSCRF Communication Fact Findings

Redefine Pension Fund Governance

It's clear that not only communication about state pensions needs to be improved (complete, balanced and structured), but also 'pension governance' has to be redefined to a more general and strategic level where a vision, mission statement and a strategic plan are defined and where responsibilities and power of the comptroller are set 'in line' with these documents.

Until now, Comptroller Thomas DiNapoli 'is responsible for making sure the CRF meets its annual performance benchmarks'.

It's clear that this definition does not cover an overall responsibility to ensure a healthy sustainable pension system in the future.

Comptroller DiNapoli must be given 'full control' in order to do his job well. His responsibilities and targets must not be limited to the performance of just the asset side of the balance sheet.

Last but not Least

If the upcoming GASB rules are adopted, as expected, retirement plan funding ratios would drop dramatically. The Center for Retirement Research (CRR) found that if the new rules had been in effect in 2010, funding levels would drop from 76% percent funded to 57%.

In short the CRR-Report sets (in summary) the new pension tone:

In case of the New York City Employee Retirement System (ERS) new GASB rules would imply a decrease in funded ratio from 77% to 50%.......

Final Conclusions:

I guess it all comes down on Honesty, as Billy Joel already stated..

Used Sources & Related links:

- NYSCRF 2011 Comprehensive Annual Financial Report (PDF)

- PEW Report (2012)

- Interactive ' funding of pensions and retiree health care' (2010)

- Wisconsin proves the lie of Pew pension numbers (2012)

- CRR Report: How would GASB affect pension reporting? (2012;PDF)

Some common real live OPE examples: 'Speed Limit 100', 'Temperature 70° ', 'Post Stamp 33', etc....

To give 'estimates' meaning, we have to put them in context:

- To define a post stamp value, just a simple number on a post mark isn't enough. We need more information, like currency, country, date, uniqueness and 'stamped' or 'not-stamped' information to determine a more precise value of a certain stamp.

- A speed limit of 100 has only meaning if you know if it's measured in Mph or Km/h.

- If you measure the temperature it's important to know whether you measure in ℃ or in ℉.

Stretching Technique

From now on if you're confronted with a 'One Point Estimate' in life, ask yourself the next question:

How can I stretch a one dimensional One Point Estimate

into a two dimensional graphic in more than one way?

into a two dimensional graphic in more than one way?

The way to stretch a point, is to stretch your mind.

Let's tak a look at a simple example.

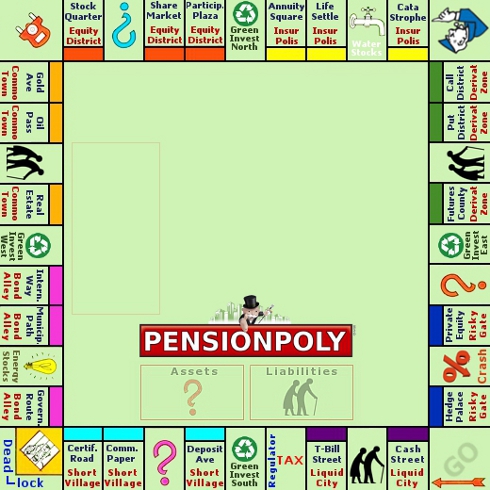

Application:Pension Funded Ratio

Just reporting a 90% Funded Ratio (FR) is in fact no-information. It's what I call a 'One Point Estimate' (OPE) that hardly adds any relevant information to you as a pension fund member.

At the best, it only raises questions.

More likely, this information leads to misunderstanding, confusion or even panic.

Reporting values on a 'time scale' is often the first attempt to stretch information in order to enable pension fund members to gain insight into the (future) development and direction of the funded ratio.

This kind of reporting gives pension fund members an idea about the short term variance and direction of the funded ratio, but still lacks information about 'how' and 'why'.

Level 3: Reporting values as function of their dependent variable(s)

On this level the added value of stretching an OPE becomes really visible.

Key question you have to ask yourself is: what are the main variables that influence the outcome (funded ratio) most?

As the expected future return and/or discount rate is one of the most relevant variables, it's illustrative and clarifying to express the funded ratio as a function of for instance the discount rate.

By doing so, every pension fund member can conclude that (in this case) the pension fund needs a future return of at least 4% p.a. to meet its obligations and that the 'solution area' (triangle 'A'), gives visible information about the 'space' or room for future indexation or pension-improvement at higher return rates.

Our two-dimensional diagram is now enriched with additional information of other vital variables that influence the pension funded ratio outcome.

We start with the estimated effect of future longevity development.

As pension fund members can note, the solution triangle area 'A' is now substantially reduced and a minimal return of (in this case) 5% is needed to fund pensions in a sustainable way.

Level 5: Adding additional information 2: Confidence level (CL)

Next, several confidence levels, based upon (future) regulatory demands, are plotted in the diagram.

For example, we may plot:

- the 97.5% confidence level (CL) as current risk appetite of a specific pension fund (is it enough?)

- the 99.5% CL European insurers have to meet in Solvency II demands. As Solvency demands will probably also apply for pension funds in the near future, this level becomes relevant in a proactive approach.

- The 99.5% CL that's applicable in Basel III demands for Banks.

In this case it becomes visible and clear to every pension fund member (and probably also every pension fund board member!), that 'more secure confidence levels', as well as 'future upcoming regulatory confidence levels' demand unrealistic high returns of this pension fund under study. As the confidence level increases, the solution area 'A' stepwise shrinks to zero.

In this specific case the pension fund has no other choice than to lower its future pension rights or to accept a higher risk of not meeting its pension obligations.

Key Question

Key question for YOU: Have you done the above exercise with your pension fund?

Pleas answer this question Honestly...

If the answer is NO, just keep on hoping things will turn out for the best......

By the way, you don't need to be an actuary to ask your pension board to inform you by means of the above formulated simple diagrams. I hope you get clear answers...

What's the difference between 'Pension Board' and 'Pension Bored'?

Practice Check: NYSCRF

Let's reflect the above approach on the third-largest public pension fund in the United States, the New York State Common Retirement Fund (NYSCRF)First, just watch the next video in which New York State Comptroller Thomas P. DiNapoli tries to explain that based on the fact that NYSCRF has 'worked' for more than 90 years, it will continue to work for many years to come.

Although Thomas DiNapoli probably does his utmost best and tries to reassure us that NYSCRF is fully under control, communication and taken measures unfortunately do not underline this standpoint:

NYSCRF Communication Fact Findings

- Annual reports and additional communication mainly report about the asset side of the balance sheet and not about the liability side

- No Mission Statement or Strategic plan can be found on either the NYSCRF-website or in the annual report (how to steer without a general target?)

- No risk appetite is communicated and no confidence levels are publicized, communicated or mentioned in the annual reports.

-

Merely a level-2 kind of information about the 'Funded Ratio' is given in the NYSCRF annual 2011 report, without any consequences.

Although the Funded Ratio is rapidly declining, the annual report does not transparently explains 'why' and 'what can be done about it'.

- No mentioning of the possible effects of available PEW information that the Governmental Accounting Standards Board (GASB) is considering new rules that would decrease the funded ration substantially

Redefine Pension Fund Governance

It's clear that not only communication about state pensions needs to be improved (complete, balanced and structured), but also 'pension governance' has to be redefined to a more general and strategic level where a vision, mission statement and a strategic plan are defined and where responsibilities and power of the comptroller are set 'in line' with these documents.

Until now, Comptroller Thomas DiNapoli 'is responsible for making sure the CRF meets its annual performance benchmarks'.

It's clear that this definition does not cover an overall responsibility to ensure a healthy sustainable pension system in the future.

Comptroller DiNapoli must be given 'full control' in order to do his job well. His responsibilities and targets must not be limited to the performance of just the asset side of the balance sheet.

Last but not Least

In short the CRR-Report sets (in summary) the new pension tone:

- Under the GASB standards, state and local plans generally follow an actuarial model and discount their liabilities by the long-term yield on the assets held in the pension fund, roughly 8 percent.

- Most economists contend that the discount rate should reflect the risk associated with the liabilities and, given that benefits are guaranteed under most state laws, the appropriate discount factor is closer to the riskless rate.

- The point is not that liabilities should be larger or smaller, but rather that the discount rate should reflect the nature of the liabilities; the characteristics of the assets backing the liabilities are irrelevant

In case of the New York City Employee Retirement System (ERS) new GASB rules would imply a decrease in funded ratio from 77% to 50%.......

Final Conclusions:

- Take adequate measures before its too late

- Get realistic and Honest, with ourselves and to others

I guess it all comes down on Honesty, as Billy Joel already stated..

Used Sources & Related links:

- NYSCRF 2011 Comprehensive Annual Financial Report (PDF)

- PEW Report (2012)

- Interactive ' funding of pensions and retiree health care' (2010)

- Wisconsin proves the lie of Pew pension numbers (2012)

- CRR Report: How would GASB affect pension reporting? (2012;PDF)