A happy new year to all Actuary-Info readers!

While actuaries and other risk mangers are still trying to cope with 'real' (btw: what's really real?) risks, a lot of other people are still worried about the risk of risks:

The end of the world

as (assumed) predicted by the Mayans!

Maya Calendar Explained

Consult Cathryn Reese-Taylor (program director, department Archeology University of Calgary) (

or read this link) for who's interested in the interesting explanation behind the end of the Maya calender.

In short, it turns out that 21 December 2012 is simply the end of the 13th baktun, a period of roughly 5200 years that the Maya used as a period-unit for counting time. Just like we in our culture use

millennial periods for constructing time.

Besides this fact, the Maya predicted other events far into the future, well beyond 2012. Problem solved!

2012: year of Risks

Having said all of this, it doesn't imply that 2012 will not turn out to become a year of risks: (aamof) It Will!

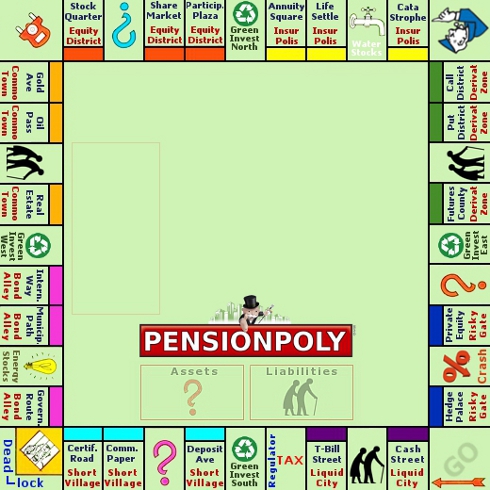

New Risk Management

Main issue will be that we'll have to change our view on Risk Management in 2012 from a classical view to a new self-conscious view ...

The old classical view goes something like this:

In the old view, Regulation and Governance are more or less considered as 'constant' and as a 'condition you have to meet'.

However,

nothing is farther from the truth.

In the last decade we've seen that changes in Regulation substantially have influenced the way we calculated, perceived and managed risk. The obvious examples are everywhere around us: Solvency II, Basel I/II/III, AIFMD, MIFID, OTC, etc., etc.........

So, in fact the new simplified Risk Management looks (less spectacular) more like this:

In this 'New' Risk Model,

EVERYTHING -including Risk management itself, is considered as RISK!

Main issue is not to take anything (or risk) for granted and to (re)consider each risk element (minimal) once a year in order to keep RISK FIT.

Just a few illustrations on some of the new risk topics to set the mind in the right direction:

I. Regulation Risk

It's not just a case of checking if you're Regulation Risk Compliant. It's also anticipating on coming new legislation, directives and rules. Not only 'formal' new directives (like Solvency) but also informal rules like

CSR's "

acting green" are important. Not acting pro-active could cause a severe reputation risk.

II. Governance Risk

It's not only about improving (corporate) governance quality and reducing the risk of governance failures, it's more. Managing the risk of governance risk, is double and

independent checking on:

- Truly independence of (supervisory) board members

- Timely (3 years) rotation

- Appointing timely 'new' knowledge in boards, audit/investment committees

- Transparent reporting to shareholders and regulators about (different) views

and explaining

WHY decisions have been taken the way they are, including

pro and contra arguments.

III. 'Risk Appetite' Risk

- Check (by reporting!) regularly if your risk budget and risk results

(SD, Sharpe Ratio, Sortino Ratio, Information ratio, etc) are still in

line with your risk appetite. If not: Act upon it!

- Compare your risk appetite and the results with those of compettitors.

IV. Models and Data Risk

Change and adapt your data and used models regularly with reality.

You do? ......

E.g.: Risk is not just Standard Deviation (SD). If so, why are Efficient frontiers in ALM still calculated and published on basis of simple (but not applicable anymore!) SD.

Anyhow.... Risky and Happy 2012 Risks!

Related Links:

-

Definitions: SD, Sharpe Ratio, Sortino Ratio, Information ratio, etc

-

PWC European financial regulation updates

-

EIFR

-

Bloomberg Financial regulation

-

ICFR: What does good regulation look like?