This decade of quantum reality and quantum risk must have been foreseen by Charles Dickens:

Applying Dickens' wisdom to Europe: Europe will break up, Europe will survive....... Who knows?

Let's dive a little deeper to find out what's happening.

Different interests

First of all different countries in Europe have different interests in the outcome of this debt crisis as the next charts (2010 data) of the Telegraph (nov 2011) show:

Update

It's hard to get actual data on this subject (how about transparency?), however the 'Deutsche Bundesbank' opens up a bit, as the next table shows:

This table (3) clearly shows that Germany is increasingly funding the poor (default) positions of a number of countries.

Countries like Ireland, Greece, Portugal and Spain are in an extremely difficult and hopeless position.

Even France is 'on the wrong side' and moving in the wrong direction.....

As long as these bad performing countries are not showing any progress in getting their national finance under control and diminishing their debt, other countries like Germany, Luxembourg and The Netherlands are throwing the money of their citizens into the bottomless pit of countries that can't take care of themselves.

As long as Europe cannot force individual member states to take appropriate measures, it's on a on a collision course and will eventually default.

For years now, Germany is putting a lot of energy and - even more - financial support in keeping Europe alive.

Despite this laudable way of acting, it's clear that if other countries don't catch up, the end of Europe is in sight.

The most horrible scenario is of course: a major (hyper)inflation in Europe.

Therefore, Germany, Luxembourg and The Netherlands would be wise to finance other countries only on basis of inflation-indexed-loans.

This way countries can't escape by means of (stimulated) inflation.

Different types of roulette

The situation above is like a desperate German player in a casino in a lonely town.......

His European family lost a fortune that night....

In order to 'save' his family, he takes his 'responsibility' and decides to play 'double or nothing' by putting all his money on 'red' and hope for the best.

Meanwhile, his family continues to gamble on the other casino tables, as if nothing has happened.

As Germans can calculate like no other, our Bundes-player knows he eventually can not win at roulette. But he has to play to prevent a family default.

Unfortunately, the German player doesn't realize he's not playing 'normal' European roulette, based on one green pocket.......

NO.., it's getting worse.......

Our German player is not even playing American roulette, with two green pockets and (therefore) less chance of winning.....

In fact our unlucky German friend is playing a kind of 'World roulette'..... as this inevitable European Debt Game will infect the world economy....

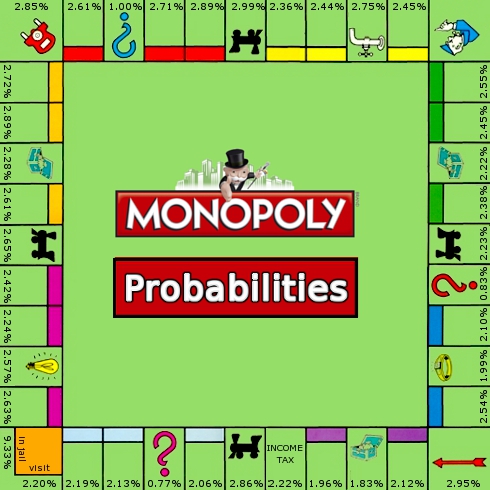

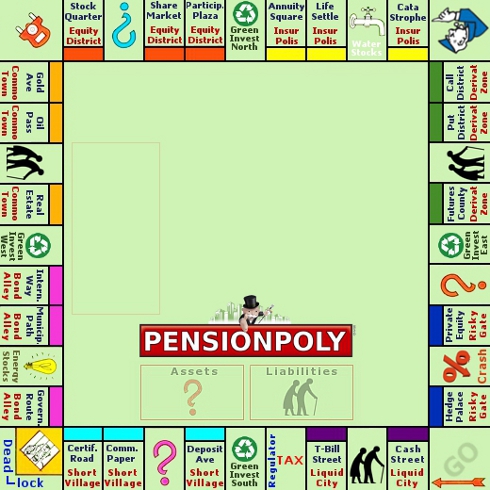

In 'economic practice' the situation is more risky than at the roulette table, as with roulette you can exactly calculate your probabilities, while in 'real life' you are not sure of your probabilities.

That's what Risk Management is all about, isn't it?

Keep following Europe the next months, as this story will continue.....

Next blog.... better news!

Sources/Related Links:

- DBB:Euroland's hidden balance-of-payments crisis

- Bundesbank sinks deeper into debt saving Europe

- Bank exposure data (Bank for International Settlements, table 9D)

- Debt as percentage of GDP and total debt (Eurostat).

- ECB Stats

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to heaven, we were all going direct the other way - in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.

Charles Dickens,

English novelist (1812 - 1870), A Tale of Two Cities

Charles Dickens,

English novelist (1812 - 1870), A Tale of Two Cities

Applying Dickens' wisdom to Europe: Europe will break up, Europe will survive....... Who knows?

Let's dive a little deeper to find out what's happening.

First of all different countries in Europe have different interests in the outcome of this debt crisis as the next charts (2010 data) of the Telegraph (nov 2011) show:

Update

It's hard to get actual data on this subject (how about transparency?), however the 'Deutsche Bundesbank' opens up a bit, as the next table shows:

This table (3) clearly shows that Germany is increasingly funding the poor (default) positions of a number of countries.

Countries like Ireland, Greece, Portugal and Spain are in an extremely difficult and hopeless position.

Even France is 'on the wrong side' and moving in the wrong direction.....

As long as these bad performing countries are not showing any progress in getting their national finance under control and diminishing their debt, other countries like Germany, Luxembourg and The Netherlands are throwing the money of their citizens into the bottomless pit of countries that can't take care of themselves.

As long as Europe cannot force individual member states to take appropriate measures, it's on a on a collision course and will eventually default.

For years now, Germany is putting a lot of energy and - even more - financial support in keeping Europe alive.

Despite this laudable way of acting, it's clear that if other countries don't catch up, the end of Europe is in sight.

The most horrible scenario is of course: a major (hyper)inflation in Europe.

Therefore, Germany, Luxembourg and The Netherlands would be wise to finance other countries only on basis of inflation-indexed-loans.

This way countries can't escape by means of (stimulated) inflation.

Different types of roulette

The situation above is like a desperate German player in a casino in a lonely town.......

His European family lost a fortune that night....

In order to 'save' his family, he takes his 'responsibility' and decides to play 'double or nothing' by putting all his money on 'red' and hope for the best.

Meanwhile, his family continues to gamble on the other casino tables, as if nothing has happened.

As Germans can calculate like no other, our Bundes-player knows he eventually can not win at roulette. But he has to play to prevent a family default.

Unfortunately, the German player doesn't realize he's not playing 'normal' European roulette, based on one green pocket.......

NO.., it's getting worse.......

Our German player is not even playing American roulette, with two green pockets and (therefore) less chance of winning.....

In fact our unlucky German friend is playing a kind of 'World roulette'..... as this inevitable European Debt Game will infect the world economy....

In 'economic practice' the situation is more risky than at the roulette table, as with roulette you can exactly calculate your probabilities, while in 'real life' you are not sure of your probabilities.

That's what Risk Management is all about, isn't it?

Keep following Europe the next months, as this story will continue.....

Next blog.... better news!

Sources/Related Links:

- DBB:Euroland's hidden balance-of-payments crisis

- Bundesbank sinks deeper into debt saving Europe

- Bank exposure data (Bank for International Settlements, table 9D)

- Debt as percentage of GDP and total debt (Eurostat).

- ECB Stats