Brainteaser...... What skills do you need to manage a pension fund?

Whatever brilliant your answer, I'm sure that the 'art of playing Monopoly' wasn't a part of it.

Yet, playing Monopoly and managing a pension fund [ let's call it Pensionpoly] have a lot in common nowadays.

The main difference is that with Monopoly you can actually calculate the probability you land on one of the forty squares, while in Pensionpoly you THINK you can calculate the probability of the return of a certain asset class.

The similarities between Monopoly and Pensionpoly are that while executing a certain buying strategy (whether houses, hotels, stocks, bonds or other asset classes), the - short term - outcome also depends on the (financial) effects of the squares we land on and on a number of uncertain events as a result of drawing Chance and Community Chest cards.

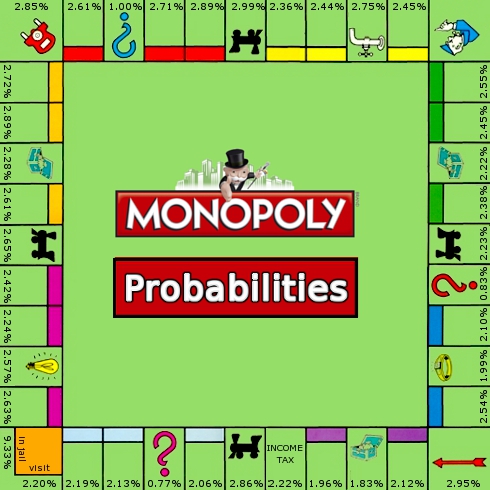

Monopoly probabilities

As described by Jörg Bewersdorff, the probability of landing on a particular square, basically can be calculated either on basis of Markov Chains or by means of applying the famous Monte Carlo method.

As an example here's the outcome of lending on a particular square on basis of a Monte Carlo simulation (more than 60.000 observations).

What's striking is that there's a 9.3% chance of ending up in jail.....

Of course, playing Monopoly takes a lot more than just calculating the probability on which square you'll be landing. Some excellent calculations have been made by Truman Collins (2005) , that include:

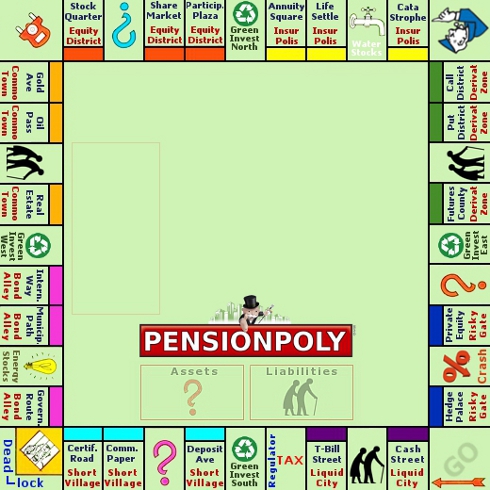

Pensionpoly

Back to Pensionpoly....

You can now practice you skills in playing Pensionpoly by downloading the Pensionpoly board game here.

Unzip (no viruses) the download (2Mb) file, click on 'Monopoly.exe' and start playing Pensionpoly in a minute.

Playing Pensionpoly is like playing Monopoly, with the following main differences:

Pensionpoly is a nice example of what is called Gamification. More info about this subject on Pension Gamification.....

Have fun playing Pensionpoly and don't forget to play normal Monopoly with this application as well !

Sources and related links

- Bewersdorff: Monopoly in the view of mathematics (2002)

- German: Monopoly im Blickwinkel der Mathematik

- Collins: Probabilities in the Game of Monopoly (2005)

- Create your own Monopoly at Parkeeerbonnen (Dutch)

- Direct download Monopoly from Parkeerbonnen

- Markov Chains and Monopoly (Scribd)

- 18-karat solid gold Monopoly set (Museum of American Finance)

Download

- - Download Pensionpoly (zip file)

Whatever brilliant your answer, I'm sure that the 'art of playing Monopoly' wasn't a part of it.

Yet, playing Monopoly and managing a pension fund [ let's call it Pensionpoly] have a lot in common nowadays.

The main difference is that with Monopoly you can actually calculate the probability you land on one of the forty squares, while in Pensionpoly you THINK you can calculate the probability of the return of a certain asset class.

The similarities between Monopoly and Pensionpoly are that while executing a certain buying strategy (whether houses, hotels, stocks, bonds or other asset classes), the - short term - outcome also depends on the (financial) effects of the squares we land on and on a number of uncertain events as a result of drawing Chance and Community Chest cards.

Monopoly probabilities

As described by Jörg Bewersdorff, the probability of landing on a particular square, basically can be calculated either on basis of Markov Chains or by means of applying the famous Monte Carlo method.

As an example here's the outcome of lending on a particular square on basis of a Monte Carlo simulation (more than 60.000 observations).

What's striking is that there's a 9.3% chance of ending up in jail.....

Of course, playing Monopoly takes a lot more than just calculating the probability on which square you'll be landing. Some excellent calculations have been made by Truman Collins (2005) , that include:

- Long term probabilities for ending up on each of the squares

- Expected income per opponent roll on all properties and other squares

- Expected number of opponent rolls to lose or recoup mortgages

Pensionpoly

Back to Pensionpoly....

You can now practice you skills in playing Pensionpoly by downloading the Pensionpoly board game here.

Unzip (no viruses) the download (2Mb) file, click on 'Monopoly.exe' and start playing Pensionpoly in a minute.

Playing Pensionpoly is like playing Monopoly, with the following main differences:

- Cities are replaced by Asset Classes

- Streets are investment categories in a certain Asset Class

- 'Buying Houses' is replaced by hiring (buying, appointing) Fund Managers (F-Managers);

- Five Fund managers make no Hotel, but a Fund Team (F-Team)

- Chance cards are replaced by Asset (chance) cards

- Community Chest cards are replaced by Liability (chance) cards

Pensionpoly is a nice example of what is called Gamification. More info about this subject on Pension Gamification.....

Have fun playing Pensionpoly and don't forget to play normal Monopoly with this application as well !

Sources and related links

- Bewersdorff: Monopoly in the view of mathematics (2002)

- German: Monopoly im Blickwinkel der Mathematik

- Collins: Probabilities in the Game of Monopoly (2005)

- Create your own Monopoly at Parkeeerbonnen (Dutch)

- Direct download Monopoly from Parkeerbonnen

- Markov Chains and Monopoly (Scribd)

- 18-karat solid gold Monopoly set (Museum of American Finance)

Download

- - Download Pensionpoly (zip file)