Imagine you're a new pension fund member and your pension fund offers you the next simple proposal regarding your future pension income.

With closed eyes you are allowed to take out two 'pension eggs', either from nest I or nest II. Which nest do you choose?

Think about this proposal and remember: your complete financial old age depends solely on the nest of your choice.

I discussed the above dilemma last week (august 2013) in a presentation with an across-section of Dutch pension representatives. This dilemma illustrates in a simple way the precarious choice Dutch pension funds and their members have to make in deciding between a traditional Nominal Pension with conditional CPI-indexation (nest I) and a fully CPI-indexed 'Real' Pension (nest II).

Key point is that to achieve a higher Real Pension, you have to put your Nominal Pension 'at risk'.

And who is consciously willing to put 'future income' substantial at risk?

As 'pension income' is in fact 'deferred income', there's also a kind of implicit understanding that your future retirement income security should be 'in line' with your actual income security and not substantial lower.

Retirement Income Security ≈ Actual Income Security ?

No wonder that all of the 23 attendees at my presentation chose Nest I (Nominal + Indexation) as favorite.

Remark

After the meeting one of the attendees stated that the '10'-valued egg in Nest II should have been valued at at least a value of 20 or higher to create an equal or higher average expectation, as higher risk would implicate also higher return.

I positively smiled for a moment... told him that his remark (and many others that followed) was formally right and suggested that he would test the 'Pension Egg Choice' in his pension board, including an extra voting with an 20-valued egg instead of a 10-valued egg. A day later he called me back and told me the extra voting didn't substantial change the voting outcome.......

Remember that more risk doesn't automatically imply more return. If volatility (risk) increases without a well-argued expected increase in 'average return', the 'compound average return' will (even) decrease with half of its variance.

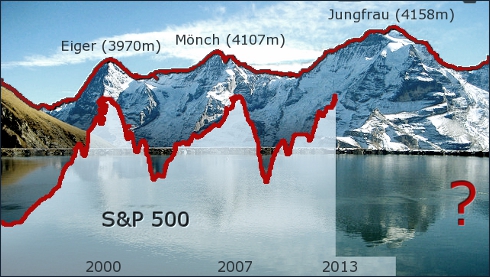

Worldwide Pension Funds Alert

Not only Dutch pension funds face the Pension Egg Dilemma, but in fact all pension funds worldwide do. To fund their pension liabilities they have to make average returns of more than 5%, 6% or even 7% for more than 50 years on a row or more. And to achieve those kind of return levels with a (nominal) risk free rate and a treasury bill outlook, both varying between 2 to 3.5 percent, implies that they'll have to invest in risky asset classes.

As a consequence the ultimate pension outcome could be lower than on basis of a risk free approach that guarantees a nominal pension. In other words: your Nominal pension is at risk.

Example

To illustrate what is happening, let's look at a 30 year old Dutch pension fund member (Tom) with an retirement age of 65.

The pension fund (theoretically) offers Tom the next options. Tom values these options on basis of a 20 year period:

- Option 1

Tom's contribution is invested in totally risk free assets at 3% (orange line), resulting in a sure (€,$,£,¥) 10000 yearly pension

- Option 2

Tom's contribution is invested in 30% risk free and 70% risky assets (purple line), resulting in a 25.9% (100%-74.1%) change of an outcome below his yearly 10000 (nominal) pension, but also an almost 50% probability of a pension of around 23904 or more.

Looking closer at the downside, there's also a 10% probability of ending up with a negative return, corresponding with a yearly pension of 4255 a year or less.

However, Tom suddenly realizes the limitations of a linear model approach. If the 'risk free asset part' of his investment is really completely independent (can't be dragged down) from the risky part and also insensitive to market conditions, there's a downside risk limitation. A 30% really 'completely market valued risk free' would in Tom's case imply a total minimal guaranteed portfolio return of nearly 1% (30% of 3% = 0.9% ≈ 1%) , corresponding with a minimal yearly pension benefit level of around 5645.

This 70% risk free approach could be quite acceptable for Tom, as he realizes there'll be no extra return without taking extra risk...

Nevertheless..., pension fund life and its member's choices ain't easy. So Tom asks the pension fund's actuary what his pension outcome would be on a 50 year evaluation basis.... here it is

Now Tom's risk of ending up with a yearly pension outcome of 10000 or less has decreased to a 15.3% (100-84.7). Tom could decrease this downside risk further to 8.6% by choosing a less risky asset mix of 70% risk free and 30% risky assets. However, this drops his upside potential. On average (50%) his pension outlook of around 23904 will drop to a little less than 17850.

Now Tom fully starts to grasp the impact of long term return assumptions... After all, is assuming a 6% or 7% 50-year return not way to optimistic?

Your own Pension Confidence Level Calculator

As shown in the examples above the key questions are i.a. :

- How much of your guaranteed* nominal pension P are you willing to risk to end up with a higher pension P+U

- How much uncertainty (100% - confidence) are you willing to accept that your pension is lower than a certain amount?

- What's the real (nonlinear) downside risk of my pension?

To find the answers to these kind of questions and to calculate your own pension perspective, you may download the

in Excel.

With the Pension Confidence Level Calculator you may calculate your pension confidence with all kind of asset mixes, co-variances, (pension) ages and several user definable life tables.

Remember the calculations are only illustrative and indicative approximations, to be used for instructional purposes. Ask your pension fund to make a more detailed and personal calculation.

Next

Now that you've experienced that most pension funds need an ambitious return that may put your nominal pension at risk, the question is what to do?

Main problem is that pension funds do not act in this alarming situation. As a kind of sitting duck they play a kind of 'waiting game' in the hope that bond yields and other markets recover.

Meanwhile you could at least do something to get the fuzzy pension picture clear. Simply follow this Cookbook :

Pension Fund Restructure Cookbook

- Your Retirement Income is not a one point estimate, so ask your pension fund's actuary:

- to calculate what future average return rate is needed to (100%) fund the liabilities, given the actual market value of the assets of the pension fund

- to calculate (estimate) your future pension at different constant future return rates

- to estimate the probability level of achieving each future return rate or more (confidence level) for the rest of your life, in accordance with the applied actuarial models

- Next, ask your actuary to formulate his advised investment risk approach in line with the Pension Eggs presentation as presented in this blog, but now with more nests.

- Now let your board and pension members determine their risk appetite by voting which nest they choose

- Finally, let the actuary in cooperation with the investment advisory committee, propose an 'investment strategy' that is completely in line with the new defined risk appetite

- Take a decision to (phase-wise) implement this new investment strategy.

Result

Perhaps the outcome of the above exercise will be a lower pension than you expected, but:

- probably not as low as you would have got if you kept on gambling on uncertain high returns

- and certainly not lower than what you need and define as a decent minimum pension income

Anyhow, enjoy the Pension Confidence Level Calculator....

Links/Downloads